Tax Audit e‑Filing Date Extension: What You Must Know

- Sep 30, 2025

- 4 min read

Tax Audit e‑Filing Date Extension: What You Must Know.

What is a Tax Audit (under Income Tax law)?

In India, under Section 44AB of the Income Tax Act, certain taxpayers — typically businesses or professionals whose turnover or gross receipts exceed specified thresholds — are mandated to get their accounts audited by a chartered accountant. The auditor then submits an audit report in the specified form (e.g. Form 3CA/3CB/3CD) as part of the Income Tax Return (ITR) process.

If you fall under this requirement, filing your ITR without the audit report is not valid; the audit report must be filed before or along with your return, within the deadline.

Why is the Deadline Extension Important?

Timely compliance is crucial because delays attract penalties (for example under Section 271B). Also, late audit report or ITR submissions may lead to disallowance of certain deductions, loss of ability to carry forward losses, or other adverse consequences.

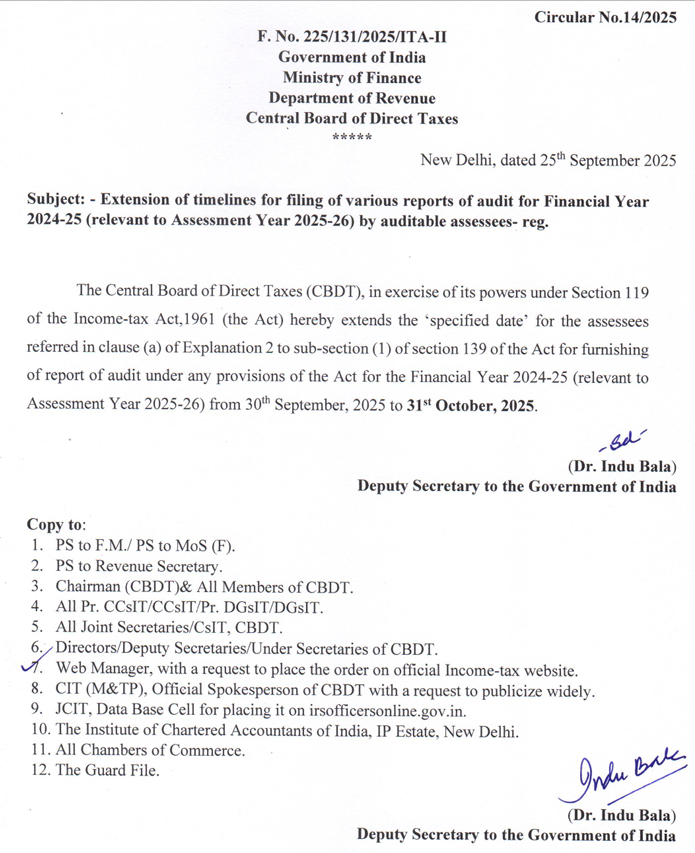

In 2025, for instance, as per notification, the CBDT extended the deadline for filing tax audit reports for FY 2024‑25 (AY 2025‑26) from 30 September 2025 to 31 October 2025. This extension was a relief to many assessees and professionals because audits and financial closings often take time, and last‑minute system or verification issues can pose real challenges.

The extension was specifically for assessees falling under clause (a) of Explanation 2 to sub‑section (1) of Section 139.

Note: Such extensions are typically announced by CBDT from time to time, especially in response to representations, technical issues on the e‑filing portal, or extenuating circumstances. Always keep an eye on official income tax or CBDT notifications for the latest deadlines.

Key Things to Remember with an Extension

Don’t relax entirely — even with an extension, you must complete audit work, finalize accounts, and prepare the report before the revised deadline.

The ITR filing deadline for those under audit may also be extended, but not always in lockstep. Always check whether the extension applies to both audit report and the ITR.

Delay beyond the extended date still attracts the usual penalties and may cause complications with your tax compliance.

How Digital Signatures Help Make e‑Filing Smooth

When filing audit reports and ITRs electronically, Digital Signatures (DSC – Digital Signature Certificates) play a central role in ensuring authenticity, security, and validity. Here’s how they help:

1. Legal Authentication & Integrity

A DSC binds your identity (or your organization's) to the document. In the case of audit reports, the CA or auditor signs digitally, which satisfies legal requirements under the IT Act, rules, or CBDT mandates.

It ensures data integrity — any change in the document post signing would render the signature invalid.

2. Compliances & Mandates

Many government portals (Income Tax e‑filing portal, MCA, DGFT, etc.) mandate use of Class 3 DSCs for certain types of filings. Without a valid DSC, you cannot upload signed documents, or the system may reject them.

3. Efficiency & Speed

No printing, scanning, physically signing, or courier. Everything happens online.

In tight deadlines (especially when extensions are short), digital signing saves valuable time.

4. Non-repudiation & Audit Trail

The DSC provides cryptographic proof of who signed the document and when. This is important for audits, legal compliance, or any later scrutiny.

5. Reduces Errors & Delays

Since the signing is enforced digitally, the chance of missing a signature or forgetting any mandatory fields is lower. Also, many DSC-enabled systems validate the signature in real-time.

In sum, for a seamless e‑filing experience during tight windows (or with deadline extensions), having a ready, valid digital signature is a huge advantage.

Why Choose eSolutions for Your Digital Signature Needs

Because not all DSC providers are equal. Here's why eSolutions stands out, especially for tax professionals, businesses, and CA firms:

1. Trusted & Licensed Registration Authority (RA)

eSolutions is a licensed Channel Controller / RA working with recognized CAs such as XtraTrust, eMudhra, Capricorn CA, VSign, PantaSign, IDSignCA, etc.

That means your DSCs are issued via recognized infrastructure and fully compliant with Indian laws (IT Act, rules) and accepted by government portals.

2. Experience & Scale

Operating since 2005–2006, with over 10 lakh+ DSCs already issued across India.

Wide network of more than 3,000 or more channel partners, DSPs, resellers across India.

Thus, you benefit from a provider with domain experience, economies of scale, and local support.

3. Range of DSC Products & Use‑Case Coverage

eSolutions offers Class 3 signing DSCs, DGFT DSC, foreign national DSC, combo DSCs, and USB tokens etc.

Their DSCs cover a broad set of applications: Income Tax e‑filing, GST, MCA filings, IT returns, e‑Tendering, DGFT, ICEGate, etc.

This “one-stop” coverage is helpful for firms or professionals dealing with multiple statutory filings.

4. Paperless & Fast Issuance

eSolutions offers paperless DSC issuance with online document submission, video verification, etc.

Same-day issuance in many cases, especially for simpler individual DSCs.

Because the process is streamlined, you can get a DSC ready quickly (critical when deadlines loom).

5. Support & After‑Sales Service

eSolutions emphasizes support and customer service in their marketing — from guiding you through document submission to troubleshooting token issues.

Their large partner network helps for local reach and service coverage.

6. Competitive Pricing & Offers

Their advertised pricing for Class 3 DSCs starts at competitive levels (e.g. ₹849 onwards) as per their website.

Occasional discounts or promotional rates may further aid cost-conscious users.

7. Reputation & Client Base

eSolutions lists a wide gamut of clients—from individual professionals (CA, CS, lawyers) to corporates, govt bodies, SMEs.

Over time, such adoption builds trust because users expect valid, accepted signatures and prompt support.

Comments